Keep More

Of What

You Earn

Get a custom tax strategy that puts money back into your Business

GUARANTEED

Why contractors trusT us

At Contractor Tax Incentives, our mission is to help small businesses keep more of what

they earn through proactive, customized tax-saving strategies.

Traditionally, CPAs focus on year-end compliance, leaving many business owners

without the strategic planning needed to minimize their tax burdens. We bridge that gap by

leveraging specialized tax-advantaged programs and personalized strategies that

uncover hidden savings and fuel long-term growth.

With a nationwide reach and a commitment to understanding your unique goals, we

deliver tailored solutions that maximize savings and strengthen your financial future.

Custom Tax Strategies

Designed for contractors, agricultural businesses, and care facilities. We unlock tax credits specific to your industry.

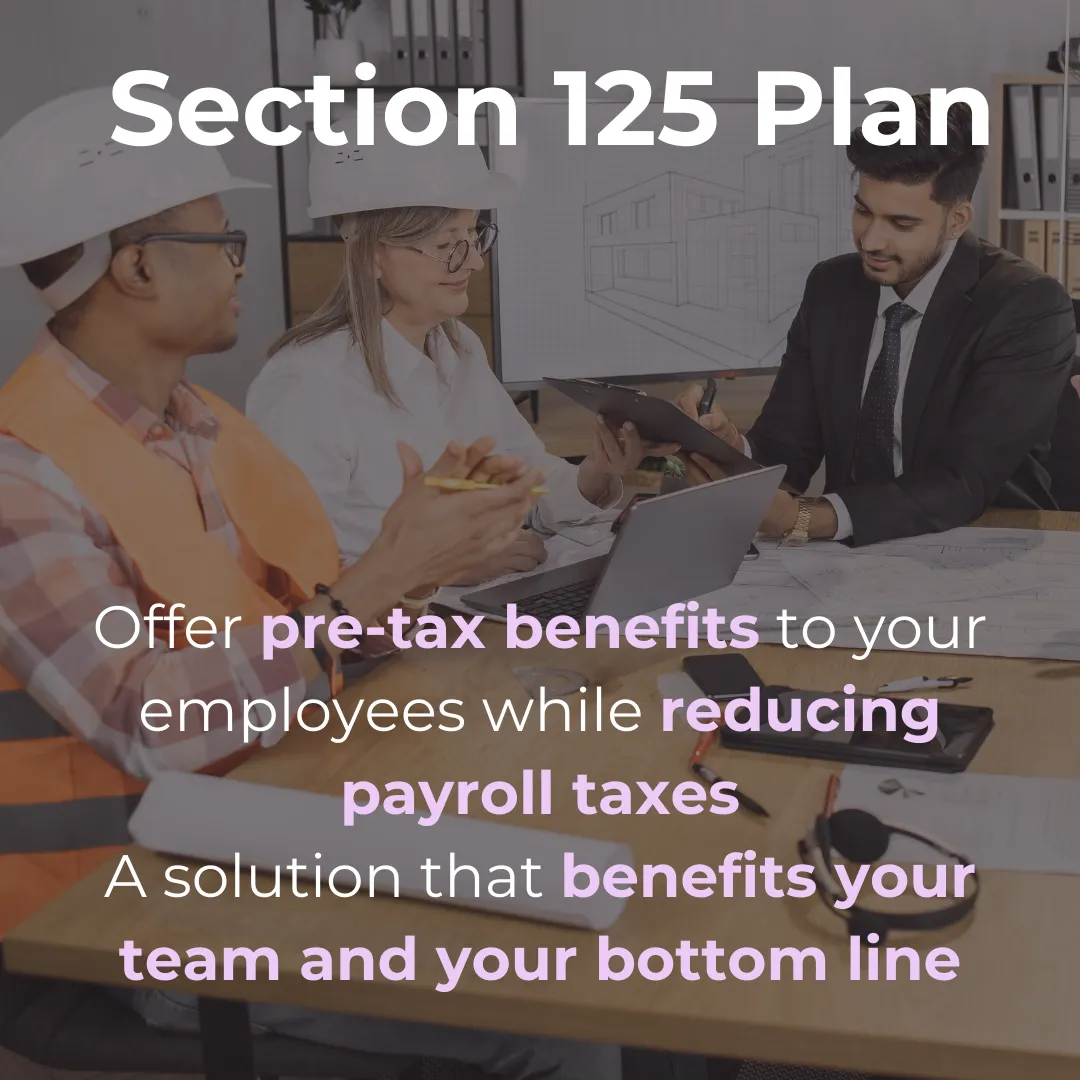

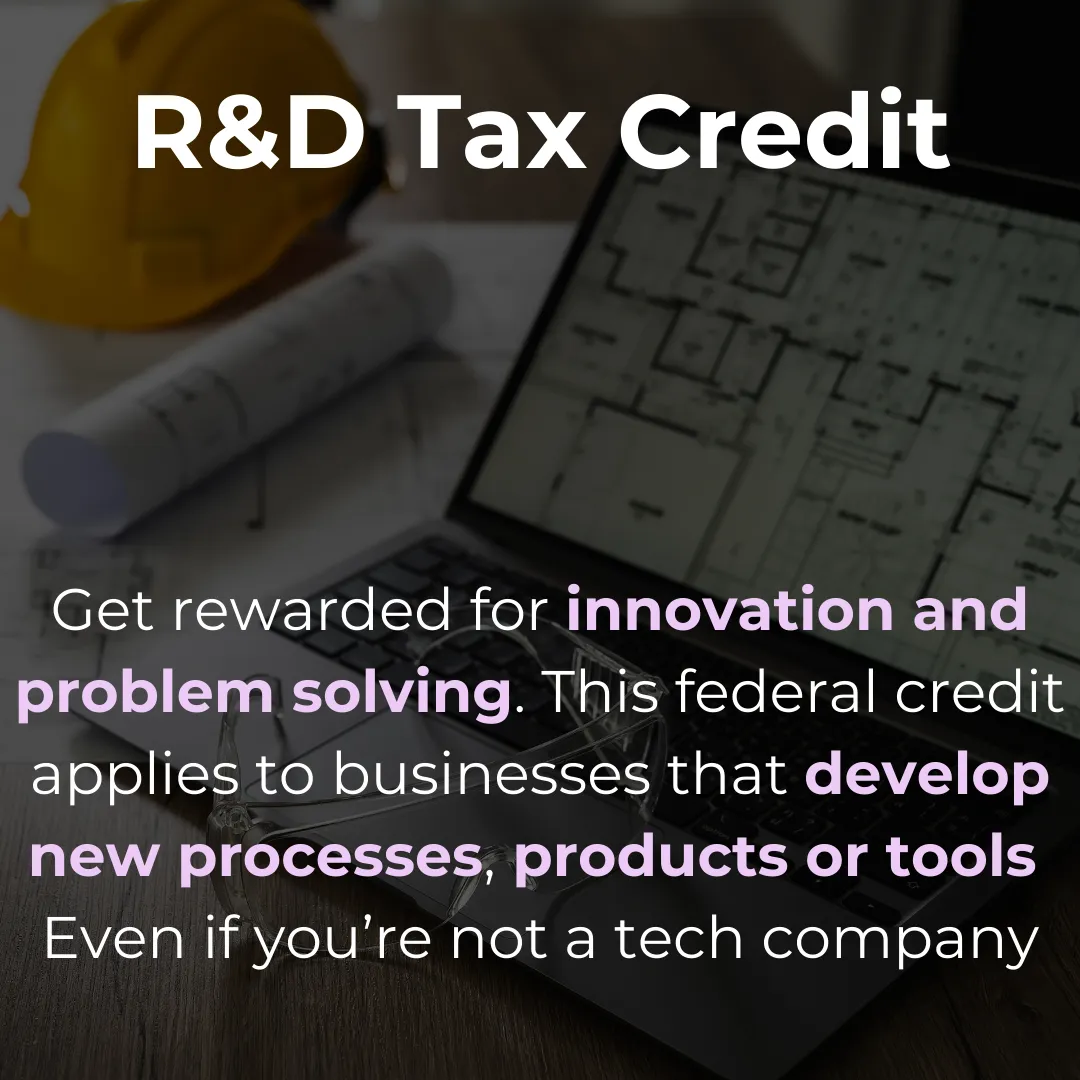

Legal Tax Reduction Tools

We use programs like Section 125, the R&D Tax Credit, and Cost Segregation to make sure you only pay what’s truly owed

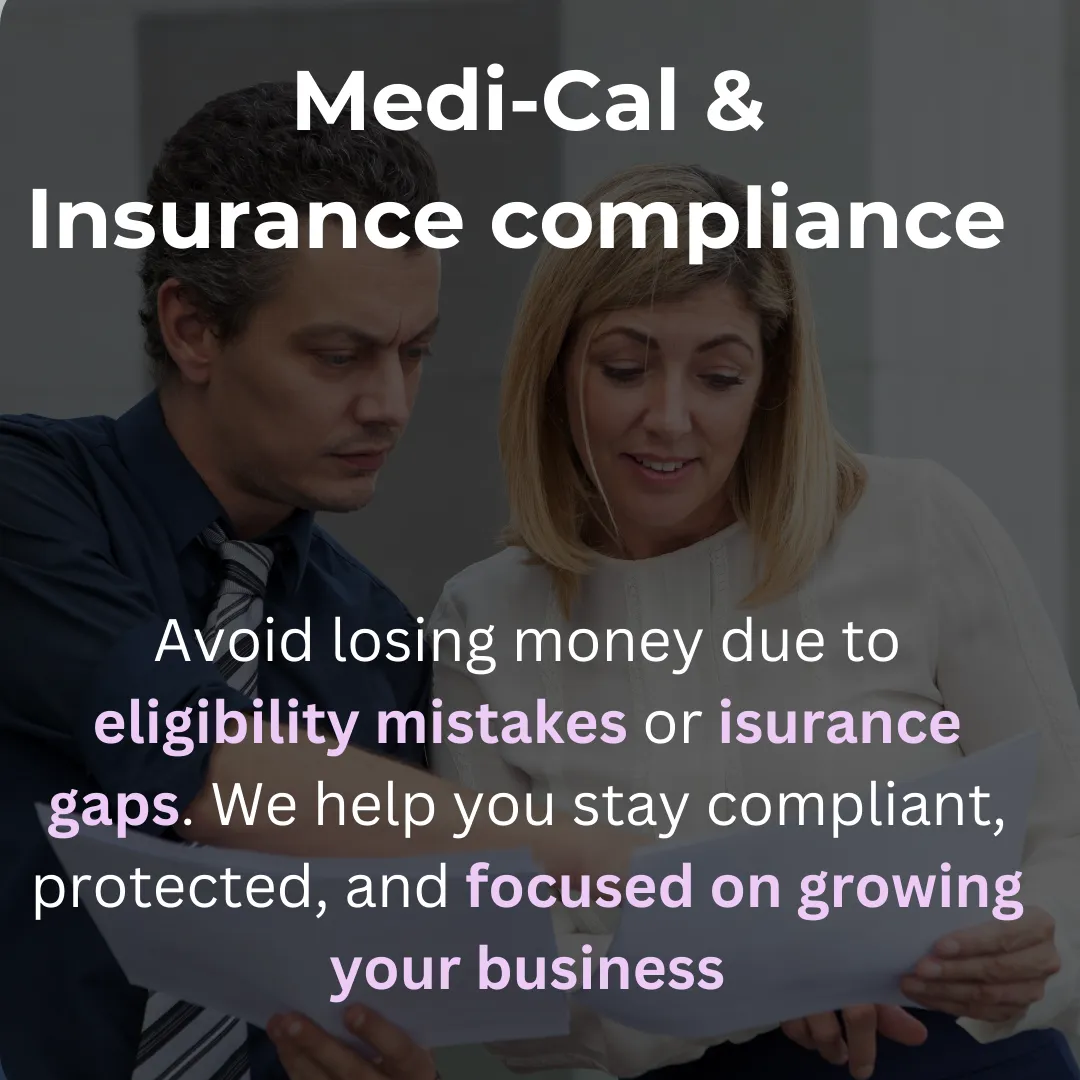

Financial Risk Protection

We identify eligibility errors, misclassified insurance policies, and other issues that can quietly drain your profits

Expert, Personalized Guidance

No cookie-cutter advice here. We explain every option in plain language, so you can make smart decisions with confidence.

Tailored Business Tax Plans

You get a strategy built for your operations, with clear steps to save money and scale — starting in year one.

Frenquently Asked Questions

What kind of tax incentives are available for contractors and small businesses?

We specialize in credits like the R&D Tax Credit, Section 125 Cafeteria Plans, and Cost Segregation — tailored to industries like construction, agriculture, and care facilities.

What is Section 125 and how can it help my business?

It allows you to offer tax-free benefits to employees, reducing both their taxable income and your payroll taxes. It’s a win-win strategy for retention and savings.

Can you help me reduce insurance or Medi-Cal compliance risks?

Yes. We audit your current coverage and program eligibility to ensure you’re not losing money due to errors or misclassifications.

How do I know if my business qualifies for these tax credits?

We offer a free eligibility review where we analyze your operations, payroll, and expenses to identify which programs you qualify for.

What if I already have an accountant or bookkeeper?

No problem! We work alongside your existing team to uncover additional savings they may have missed — without replacing anyone

Do you offer ongoing support or is it a one-time service?

We offer both — a one-time analysis or a long-term partnership. Many clients choose monthly support for consistent savings and compliance monitoring.

COMPANY

CUSTOMER CARE

LEGAL

FOLLOW US

Best Line Capital All Rights Reserved.